Despite concerns about an AI bubble and recent market dips, NVIDIA’s stock soared nearly 50% last year. This was fueled in part by government initiatives like the CHIPS Act, which helped bring advanced manufacturing back to the U.S. That enabled NVIDIA to produce its first Blackwell GPUs domestically in Q4 2025, a milestone in reshoring key production capabilities.

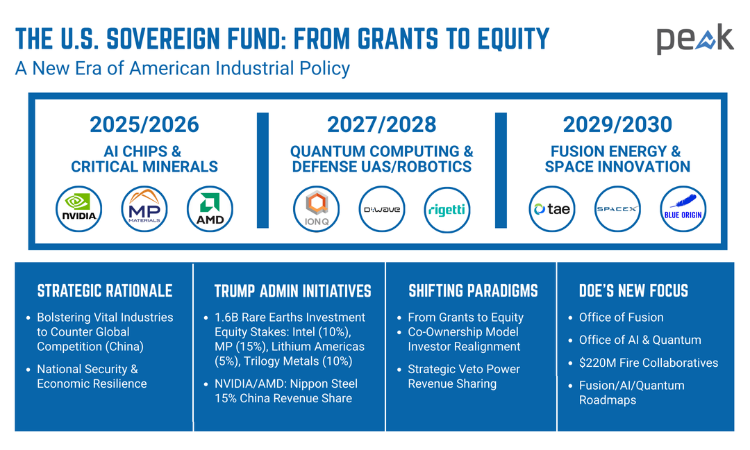

That push is accelerating. In its latest move to bolster strategically vital industries, the Trump administration announced it will invest $1.6B into a rare earths group in a bid to shore up key minerals

China’s government has forced the U.S. to increase state capital investment, having launched a $14.3B national VC fund along with three large regional funds to back “little giants” and unicorns over the next 20 years. Along with its recent $150 million investment into xLight, a semiconductor startup working to advance extreme ultraviolet lithography, the Trump administration will take an equity stake that could make the federal government the company’s largest shareholder.

These deals signal that Washington is no longer just subsidizing supply chains, but directly owning a slice of the technologies it deems essential to maintaining an edge over China in AI and semiconductors.

This shift is already evident with moves from Intel, MP Materials, and U.S. Steel, as well as in quantum computing. If momentum continues, similar public-private models could extend to fusion and other frontier technologies. Proponents argue this model will drive economic upside, accountability, and stronger alignment with national objectives, benefiting both government and American taxpayers.

From Grants to Equity Participation

Historically, government support for technologies has been limited to grants, tax credits, and low-interest loans. Co-ownership has now been added to the mix, with the administration acquiring stakes of 10% in Intel, 15% in MP Materials, and 10% in Lithium Americas and Trilogy Metals, along with a “golden share” in Nippon Steel.

Stephen Empedocles, CEO of Clark Street Associates, calls this “a new phase in how Washington approaches industrial policy,” and it parallels the sovereign fund models of the European Union and Singapore. This is an intentional departure from neoliberal laissez-faire toward sovereign capitalism, and the rationale is simple: government (and taxpayers) share in the upside, not just the subsidy. Practical implications include:

-

Investor realignment: The presence of government shareholders lowers risk and raises compliance.

-

Grant to equity: The administration is converting previous grants into equity positions that could seed a U.S. sovereign fund.

-

Strategic veto power: Government gains leverage over critical industries without the inefficiency of state management.

-

Revenue sharing: Requires companies to share revenues for sales of specific products or with specific countries with the government.

While critics caution market distortion, supporters argue selective intervention is key to protecting and developing industries for national security and economic resilience:

-

MP Materials and Lithium Americas: Ensures rare earths and lithium, essential for defense electronics and electric vehicles, are extracted and refined on domestic soil, countering China’s global dominance.

-

U.S. Steel: Protects America’s steelmaking capacity for defense contracts, infrastructure, and independent supply chains.

-

Intel: Reshapes CHIPS Act funding with Washington co-investing in semiconductor fabs, turning taxpayers into shareholders in domestic chip manufacturing.

-

NVIDIA & AMD: In a first-ever deal, the U.S. government will receive 15% of revenue from chip sales to China. This company-specific tariff turns Washington into a direct beneficiary of industry success.

Key Industries the DOE is Driving

The U.S. Department of Energy (DOE) is sharpening its focus on next-generation energy and technology through a significant reorganization, adding two new offices under the Office of Science: the Office of Fusion and the Office of Artificial Intelligence and Quantum.

These changes signal a more coordinated emphasis on fusion, AI, and quantum. The department’s 2025 AI Strategy outlines investments in these areas to accelerate research and commercialization, and its Fusion Science and Technology Roadmap outlines a “Build–Innovate–Grow” strategy to catalyze private sector fusion innovation, deployment, and standardization.

As an early-stage investor, DOE expects to invest up to $220 million in total funding for the FIRE Collaboratives to help bridge the “valley of death” between lab prototypes and commercial deployment. DOT leadership stated, “Fusion is real, near, and ready for coordinated action,” a perspective extended to AI and quantum, where standardization is also critical to scale and interoperability. Through this reorganization, DOE aims to strategically develop emerging U.S. energy and technology sectors.

The Quantum Example

Semiconductors defined the previous industrial race; quantum computing is next. In October, Reuters and The Wall Street Journal confirmed the administration was negotiating equity positions in leading quantum companies like IonQ, Rigetti Computing, and D-Wave Quantum, each with a proposed investment of $10 million or more. This sends a powerful signal of commercial legitimacy and geopolitical intent. These companies have already seen explosive market valuations in anticipation.

Quantum’s applications, from cybersecurity to advanced simulation, impact defense, finance, and intelligence. With China and the EU pouring billions into similar ventures, Washington’s decision to buy in serves as strategic deterrence through ownership.

This structure could serve as a model for other “deep-tech” sectors where markets are too risk-averse to support ten-year capital cycles. Government investment today could birth 21st-century industry.

Fusion Could Be Next

With Trump Media’s announcement to merge with TAE Energy, General Fusion’s announcement to become the first publicly traded fusion company—as well as government investment from the DOE’s milestone-driven fusion roadmap and the Fusion Industry Association lobbying Congress for nearly $10 billion—fusion is poised to be next. Transforming DOE’s fusion subsidies into equity or golden shares would embed accountability and align with national priorities like energy independence and baseload generation.

The Sovereign Experiment: A Competitive Requirement?

The U.S. is in a fierce competition with China, which heavily subsidizes key industries such as chip manufacturing and data centers, along with the energy needed to power them. While some question the wisdom of America adopting similar federal participation strategies, others believe that for critical technology sectors, markets alone cannot ensure national resilience and public value.

Always a nation of bold experimentation, the U.S. is experimenting with a sovereign wealth model adapted to 21st‑century competition. The Trump administration’s willingness to invest taxpayer dollars in strategic markets is a positive step that could level the playing field with China, strengthening U.S. competitiveness on the global stage. Only time will tell if it’s successful.